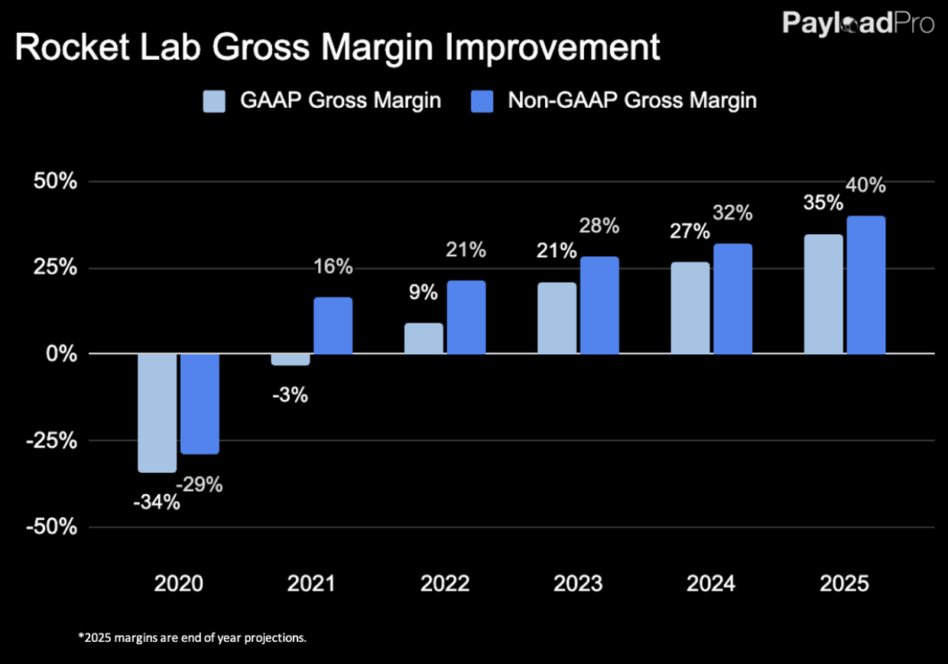

Rocket Lab is laser-focused on protecting and expanding margins. The company has improved its GAAP gross margins from -3% in 2021 to 35% today as it scales and grows through space systems acquisitions.

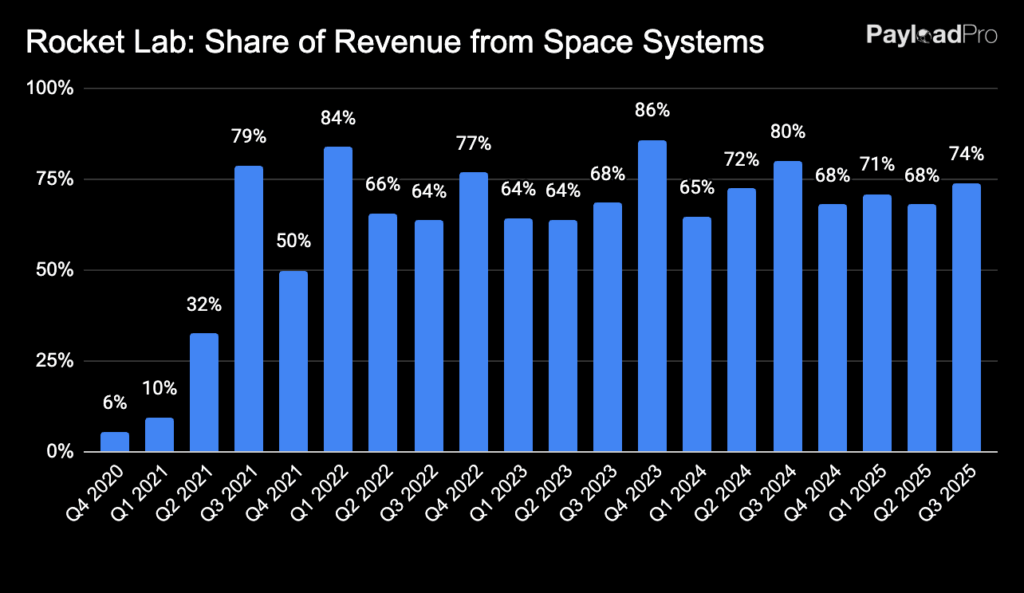

The second-most-prolific commercial launcher has grown its space systems division to 74% of revenue, tucking in a number of high-margin component businesses along the way, including:

- Sinclair Interplanetary (star trackers, reaction wheels; 2020)

- Advanced Solutions Inc. (flight software, mission simulation, GNC; 2021)

- Planetary Systems Corporation (separation systems; 2021)

- SolAero Technologies (space solar cells and arrays; 2022)

- GEOST (electro-optical and infrared payloads for national security missions; 2025)

- Mynaric (laser comms terminals; 2025 not yet closed)

The company has been selective in its M&A, only making acquisitions that are accretive to margins.

Launch margins: Electron launch margins are in the low 30s, but set to increase to 50% when Neutron comes online and can start reusing its booster (the latter achievement may take some time). Along with margin improvement, Rocket Lab has said it will enter a capex hiatus after Neutron development, aiming for positive free cash flow in the coming years.